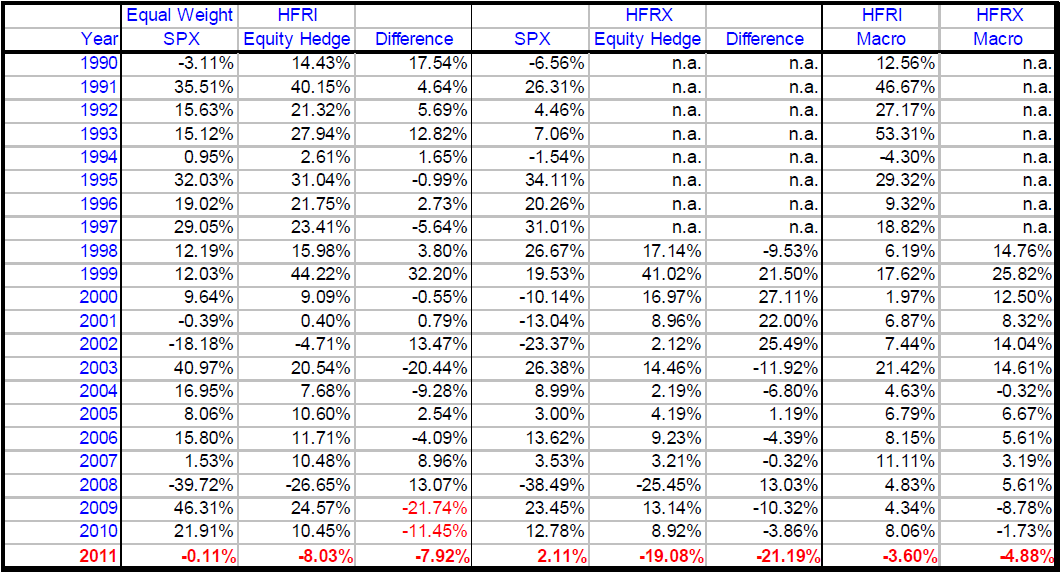

In 2008, the hedge-fund industry had ~$2 trillion under management. But as Economist’s Buttonwood [1] points out, that year was an annus horribilis for the hedge-funds. “The average performance was a loss of 23%. In cash terms the loss for that single year was more than double the industry’s total assets under management in 2000.”

This is detailed in a new book by Simon Lack titled The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True [2]. Mr Lack reckons that hedge funds have lost enough money in 2008 to cancel out the entirety of profits made in the prior ten years.

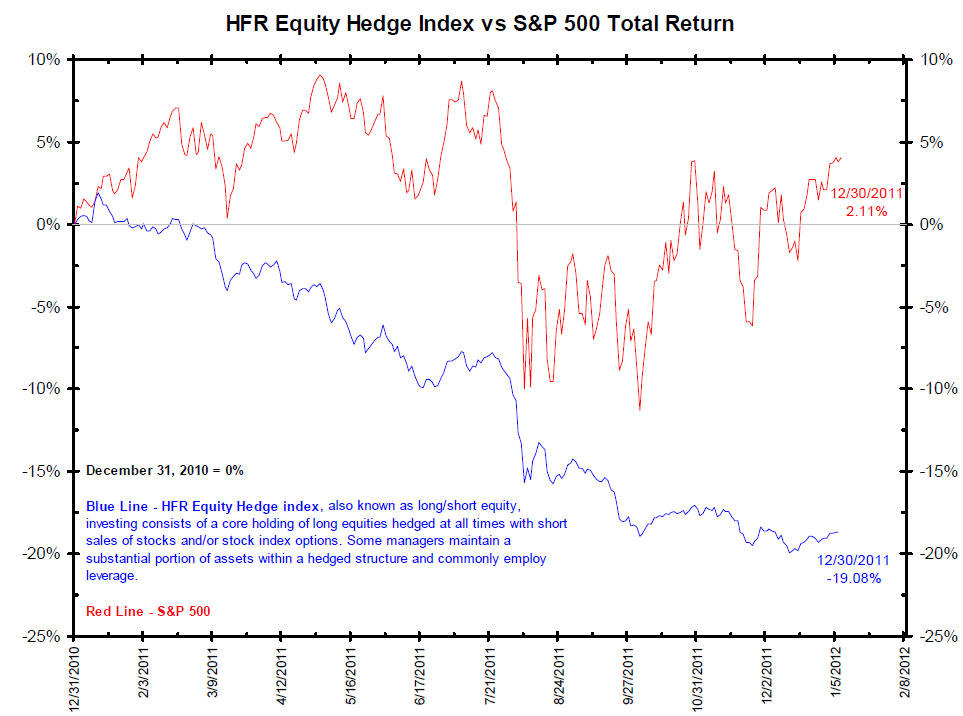

Mutual funds have not fared any better in 2011. Data from Morningstar shows that among 4,100 funds that invest in large-cap stocks, only 17% beat the SPX. That is the smallest percentage since 1997 beating their benchmark — the S&P500 — since 1997, when 12% beat the SPX. If we look at the percentage of funds under-performing by 250 basis, its the worst since 1998. (See chart below)

If you are looking for something to blame, consider the unholy trinity of capital outflows, a flat 2011 market and high volatility. That was a challenging environment for hedge funds and mutual funds alike.

I suspect people are disappointed when a mutual fund under-performs with fees of 0.75 to 1.75%. But the fee structure of Hedge fund managers — 2% + 20% of the profits — is why some of them face real trouble. Its bad enough to under perform, but institutions hate paying up for the privilege.

Perhaps 2012 is the year fund managers mean revert and redeem themselves. If they don’t they should not be surprised at massive redemptions each time their window opens.

>

Click to enlarge:

[3]

[3]˜˜˜

[4]

[4]More Charts on under-performance after the jump

[5]

[5]~~~

[6]

[6]All Charts Bianco Research [7]

>

Sources:

Rich managers, poor clients: A devastating analysis of hedge-fund returns [1]

Buttonwood

The Economist, Jan 7th 2012

http://www.economist.com/node/21542452

Why 2011 Was A Bad Year For Money Managers

Conference Call Handout, Bianco Research [7]

January 12, 2011

Hedge Funds Sit Out Stock Market Rally [8]

Nikolaj Gammeltoft

Bloomberg, January 10, 2012

http://www.bloomberg.com/news/2012-01-10/hedge-funds-sit-out-rally-with-speculation-on-stock-gains-close-to-09-low.html

Mutual Funds Trail S&P 500 Index Most Since ’97 [9]

Lu Wang

Bloomberg, Jan 10, 2012

http://www.bloomberg.com/news/2012-01-10/funds-trail-s-p-500-index-most-since-97.html

No comments:

Post a Comment