As the end of the 30 year bond bull market begrudgingly gives over to the consensus-expected rate rise, investors’ persistent worries about the impacts of falling bond prices on their portfolios have provided great opportunity for asset managers to aggressively market and/or launch “nontraditional bond” funds. Unlike core or intermediate term bond funds, which typically benchmark their asset classes, duration and performance to the Barclays U.S. Aggregate Bond Index, nontraditional bond funds generally seek to limit interest rate exposure in an effort to preserve capital in the event of higher yields and tightening monetary policy.

Likely helped by 2013’s “Taper Talk” rate rise, the industry’s marketing of these funds and rotating client assets from core bond funds has been very successful. The Morningstar Nontraditional bond category has nearly quadrupled in total number of funds over the past five years from 25 unique funds to 84 as of the start of June. This growth is even more evident when looking at assets. The universe has seen heavy and rapid inflows, more than doubling total AUM in the past 18 months from $68 billion at the end of 2012 to current aggregate AUM in excess of $145 billion. Indeed, Morningstar has deemed nontraditional bond funds’ growth rate “blistering”; over the past year, the group has gathered more assets than any Morningstar category besides Foreign Large Blend (International Equity). Comparatively, the Intermediate Term Bond category has seen a decline in the number of funds and assets, with 17% fewer funds at the end of May as there were five years ago and a 10% decrease in total category assets over the past year due to outflows.

Often used interchangeably with the label “unconstrained” bond funds (as well as “alternative” and/or “long/short”), the general principle (and hook) is that nontraditional bond managers have the flexibility to 1) invest in nearly any fixed income market, 2) make tactical allocations independent of benchmarking and 3) maintain the ability to take both long and short positions. In particular, these managers generally have more flexibility on duration management – including the aforementioned freedom to be short rates – an attractive quality as investors brace themselves for inevitable rate increases.

Despite their popularity, some feel that these funds are simply trading rate risk for credit risk in the form of high yield and emerging markets debt. With tighter correlations between low quality credit and equities, such credit risk doesn’t quite match the conservative stance many investors seek in their fixed income allocations. Debate of the role of such investments in a portfolio setting aside, both retail and institutional investors are increasingly opting to gain alternative exposure through a 40 Act structure, making the numerous (and varied) new nontraditional bond offerings an object of intense attention.

Against this backdrop, we used a quantitative lens to examine some of the characteristics of funds in the Nontraditional Bond category, looking to 1) better understand the level of homogeneity or heterogeneity in behavior and strategy, 2) evaluate some of the common risks exhibited by the category and 3) verify the perception that such funds provide lower duration risk, potentially, at the cost of higher credit risk.

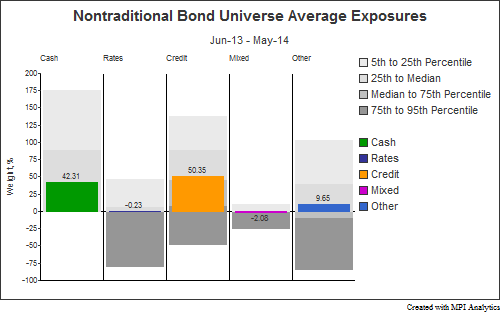

There are 58 distinct, active funds in the Nontraditional Bond category with at least 1 years’ worth of data as of the end of May 2014.[1] We used MPI’s proprietary Dynamic Style Analysis (DSA) and weekly net asset values to identify the set of factor exposures that best replicate each funds’ performance over the past year. Please note that these “factor exposures” are the result of a purely quantitative analysis and are not based on actual holdings.[2] The results can be seen in the chart below:

For simplicity in reporting, each vertical section of the graph above represents a macro basket of underlying sub-factors. For example, the “Rates” basket includes US government bonds, the “Credit” basket high yield bonds, “Mixed” includes investment grade corporates, while the “Other” category includes those assets which are comparatively insensitive to the other baskets[3], including short term bonds and issues from other developed countries. Please note that “Cash” may not always be interpreted literally; it may also represent either reduced volatility (in the case of estimated long positions) or excess volatility (in the case of estimated short positions) or else some other form of leverage.

At first glance, it seems that the general perception is correct – the nontraditional bond universe, on average, 1) exhibits very little exposure to the most rate-sensitive factors, 2) appears to have its highest exposure to credit sensitive factors and 3) displays long exposure to less rate-sensitive alternatives in the “Other” basket.

Looking past the average, however, the range of results indicated by the dispersion in the universe is extraordinarily large. Half the funds appear to have positive exposure to rate-sensitive assets, while the bottom quartile shows estimates ranging from 0% to a short position of around -80%. Similarly, long credit exposure (high yield) ranges from 0% to over 135% for three quarters of the funds, yet a significant minority have short exposure estimates.This is clearly not a homogenous group, investing in a similar fashion.

The advantage that the fund managers may have in the ability to invest anywhere to execute their investment thesis and view on rate risk appears to be a distinct challenge for fund buyers in analyzing the funds.

Using MPI’s proprietary measure of predictability, Predicted R-Squared[4], we find the median value for the group is 72%. From a quantitative modeling standpoint, this is a level more akin to a group of absolute return hedge funds than bond mutual funds. This should give investors and analysts pause. The observed value indicates that while a good proportion of the average funds’ returns can be reliably explained by the factors used, there are likely a number of missing or extraneous factors when analyzed on a fund-by-fund basis. This is not surprising as we used a set of generic factors as explanatory variables where the actual exposures could be quite specific and broad given the funds’ unconstrained approach. It is, however, an additional indicator of the disparity in investment approaches within the group.

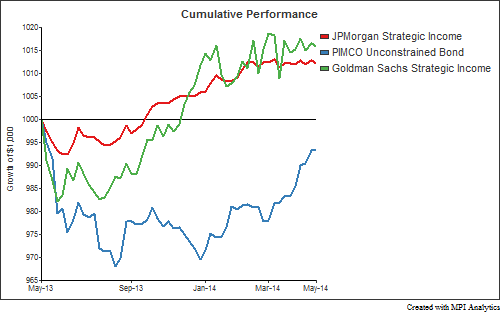

Looking at some representative funds, the impression of heterogeneity is reinforced. The three largest funds in the category by AUM are Goldman Sachs Strategic Income A (GSZAX, +$24 billion), JP Morgan Strategic Income A (JSOSX, +$26 billion) and PIMCO Unconstrained Bond Inst (PFIUX, +$22 billion). The funds’ cumulative returns for the past year are shown below. The path of their returns indicates significantly different investment approaches. The average weekly correlation between the three funds over the past year is 42%. By comparison, the average correlation between the largest three Intermediate-term bond funds (by AUM) is 93%. – the top three include industry-leading active managers Jeffrey Gundlach’s DBLTX and Bill Gross’ PTTRX, as well as the Barclays Capital U.S. Aggregate Bond Index tracking Vanguard Total Bond Market Index Inv (VBMFX).

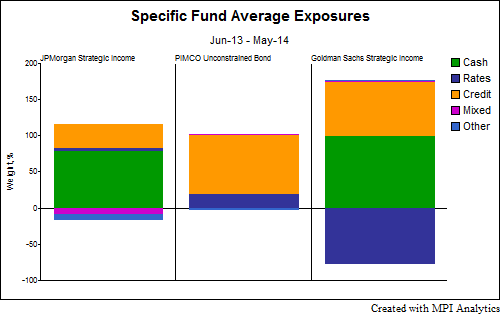

Looking at the three funds’ average exposure estimates, we can see just how dissimilar they appear in a purely quantitative replication of their performance. Please note that the generic factors used on these funds are the same as those used on the universe above and are unlikely to be the optimal mix for any one fund indvidually. Regardless, as with the fund universe , the disparity in results strongly indicates that these funds are not comparable on any but a nominal basis and require greater care on the part of investors when selecting and monitoring.

All three indicate long credit exposure, but in quite different proportions. It is also important to understand the perceived net exposures of the funds. GSZAX appears to have exposure to that which concerns most category critics – short rate-sensitive assets and long credit sensitive, with little net market exposure. JSOSX’s net market exposure is estimated at only about 20%, while PFIUX[5] appears to have full market exposure.

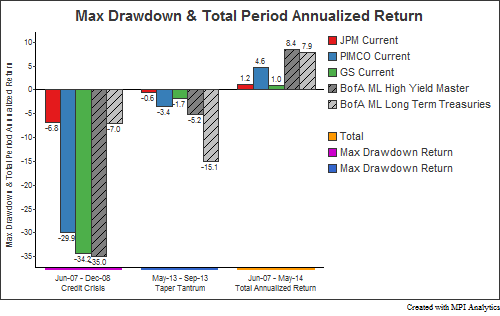

What could these differences mean to investors from a risk perspective? Seeking to answer this question, we tested the current (as of May 30, 2014) exposures for each of the funds and evaluated the replicating (dynamic beta) portfolios’ performance in terms of max drawdown return during two recent periods of stress, the Credit Crisis (June 2007- Dec. 2008) and the Taper Tantrum (May-Sept. 2013). For reference, two passive indices are included as benchmarks; the BofA ML High Yield Master II Index, and the BofA ML Treasuries index with maturities of 10+ years.

Our analysis of all three funds indicates reduced sensitivity to rate changes in 2013, although to different extents. The JP Morgan Funds shows effectively none, while the PIMCO fund retains at least some rate exposure. In terms of credit risk, again the JP Morgan fund appears to have very little – while the PIMCO fund and Goldman Sachs funds seem to take on a considerable amount. This is just an exercise, of course, and given the funds’ (varying) tactical mandates an investor shouldn’t expect the portfolio to remain stagnant in times of stress.[6]With 2014’s surprise broad bond rally YTD, particularly to long duration government bonds, it is worth noting the varying impacts on current portfolios of an intense “flight-to-quality” period, exemplified here by the Credit Crisis.

Nontraditional bond and unconstrained bond are fuzzy labels, encompassing a considerable range of investment strategies, mandates and risk exposures. This blurring of lines over a fresh-faced, fast-growing group of heterogeneous (and let’s not forget expensive) offerings renders analysts and advisors unable to rely on either category or label to know how to fairly evaluate funds in this ballooning area. Rather, individual manager analysis and the use of smaller, highly targeted peer groups (when possible) should be key in choosing a fund, and determining its role in a portfolio. This is animportant moment for asset managers too. With assets flowing to these offerings,providers must realize the importance in educating investors on the nature of these (typically) new products and their role within a portfolio orientation, as well as the opportunity to differentiate their offering(s) from an increasingly crowded pack.

[1] Implying over 30% of funds in the category have track records less than 12 months at the time of the analysis.

[2] DISCLAIMER: MPI conducts performance-based analyses and, beyond any public information, does not claim to know or insinuate what the actual strategy, positions or holdings of the funds discussed are, nor are we commenting on the quality or merits of the strategies. This analysis is purely returns-based and does not reflect insights into actual holdings. Deviations between our analysis and the actual holdings and/or management decisions made by funds are expected and inherent in any quantitative analysis. MPI makes no warranties or guarantees as to the accuracy of this statistical analysis, nor does it take any responsibility for investment decisions made by any parties based on this analysis.

[3] Which is not to say they don’t have their own risks.

[4] Beyond simple fit as indicated by R2, Predicted R2 is a cross-validation measure of the predictive value of the analysis.

[5] Bill Gross took over the management of the fund in December 2013 from Chris Dialynas and made substantial changes to the portfolio. Therefore the average exposures are unlikely to be representative of the current. For more, see: http://www.bloomberg.com/news/2014-03-05/pimco-overhauls-unconstrained-fund-as-gross-takes-control.html

[6] All three funds were operational for the Taper Tantrum period and JSOSX and PFIUX were live for a portion of the Credit Crisis period tested, launching in Q4 and Q3 of 2008, respectively. (both funds’ performance through the heavy down market indicates low net credit exposure)