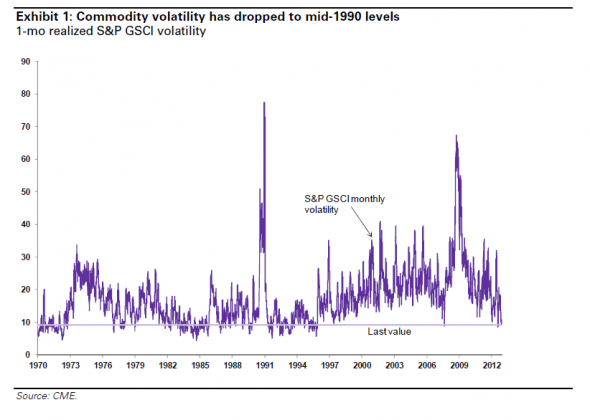

Remember the whipsawing days of 2008? The days when commodity prices couldn’t get crazier?

Well, Goldman Sachs put out a research note this week clocking that things have got awfully quiet of late. Almost strangely so.

Indeed, according to Jeffrey Currie and team, commodity volatility

has dropped far below the volatility of other asset classes, even though

the risks to both the downside (macro and policy risk) and upside

(geopolotical risks) have not gone away.

Perhaps predictably, they’re not a buyer of low volatility being a longer term trend.

You’ll be familiar with their argument. It goes like this:

On net, while we have sympathy for the view of a

structural decline in long-term commodity price volatility, we believe

the recent decline is too much too soon, both relative to commodity

market fundamentals as well as other asset classes.

Furthermore, they believe “positive carry” will now be a big driver when it comes to curve positioning.

Again much like the 1980s and 1990s, we believe the price

movements around these new stable “equilibrium” price levels are driven

by short-term demand fundamentals with emerging market demand the key

driver in the current environment. Despite concerns over “the end” of

strong commodity demand from the emerging markets, recent micro and

macro economic data from China point to continued strong demand,

particularly for oil where we believe the weakness from last year was

partially exacerbated by a de-stocking cycle.

Nice and logical.

But, they could be missing a big trick.

For one, they don’t really consider what’s driving the positive carry

in the first place. Conventionalists would say that futures pricing

lower than spot prices and offering “positive carry to investors”

implies some sort of physical disequilibrium. That there is a shortage

of supply in the market place, and that some level of destocking must

take place.

The reason investors are rewarded with positive carry is because they

are taking the risk of future “over supply” onto their own shoulders.

But, as we’ve argued, the positive carry signal and curve signals generally,

have been warped by the zero rate phenomenon to some degree.

A little bit of positive carry does not, therefore, necessarily

signal the same thing it used to. Especially if real negative rates are

being masked by the nominal zero bound.

All that positive carry has to be compared to the negative carry you

get from holding cash. Why would a producer destock, even in a

backwardated market, if the cash they received in exchange would have a

negative charge associated with it?

It’s much better to hold physical inventory. Especially if you can

reap a small positive carry from doing so because futures haven’t quite

figured this out yet. (This was the case for much of the post-crisis

period.)

The fact that futures investors have finally realised

they need to be compensated in

the form of positive carry if they are funding producer inventory —

which allows producers to dodge negative money charges — says little

about disequilibrium in the market place.

It can, however, tell you a lot about low volatility and real interest rates.

As

this paper by

Joseph W. Gruber and Robert J. Vigfusson beautifully spells out, low

volatility is always a product of low interest rates — especially in

commodity markets.

And that’s because the lower the interest rate, the bigger the incentive to hold stock.

The more stock is held, the bigger the buffer

to ease unexpected supply disruptions.

As for negative interest rates, these go even further. They don’t

just incentivise the build up of stocks, in most cases, they incentivise

complete production cuts.

It’s the negative interest artificial scarcity anomaly. If it doesn’t

pay to hold cash, it pays to squeeze the market as much as possible

instead.

Only if and when those production cuts lead to genuine shortage

issues would a producer be incentivised to destock — at the right price —

so as to cover genuine costs of operation and consumption needs. The

point being: in a negative carry universe it does not pay a commodity

owner to produce for monetary profit.

Indeed, the commodity asset is worth more if it’s not monetised at

this point. This is especially the case if the futures market is already

charging a negative carry for holding stocks above ground.

Explaining the crisis

In the run-up to 2008, it was thus the negative yield curve which

arguably encouraged — albeit unwittingly — producers on all commodity

fronts to undersupply the market. At least from a production point of

view.

After all, why transform short-term liquid assets like commodities

into cash if you have to invest them in negative yielding longer-term

assets? It’s much better to hold the commodity. And if you do sell, you

want to sell at the best price possible.

In our opinion, this negative yield force may even have contributed to the record high commodity prices of 2008.

But then, of course, came the crisis. Demand destruction set in, and

the commodity market was once again — despite the best efforts of the

industry — oversupplied. The high prices producers were using to

overcome the costs of negative monetary carry were gone.

But, oversupply did present one new opportunity for producers and

middle-men. It allowed them — at least temporarily — to scalp some much

sought after positive carry from the futures market, a market which was —

thanks to all those bullish bank notes to passive investors — still

ready to pay handsomely for keeping supply around above ground.

Which brings us to now.

As we see it, it could be that Goldman Sachs is right. The period of

low volatility will end soon, prices will either spike or fall — and

today’s destocking will lead to a more bullish environment tomorrow.

Or, it could also be that futures investors have adjusted to the cost of carry in a

negative interest

world — which means forces and incentives are now in place to ensure

price volatility is a thing of the past. Both on the upside and the

downside.

On the downside, producers are back to controlling the market with

supply cuts designed to keep prices only just above break-even levels,

which satisfy their costs of operation and consumption needs.

Meanwhile, on the upside, prices are prevented from rising far beyond these levels because of lessons learned in 2008.

First, because the 2008 experience taught producers that pushing

prices too high would only lead to temporary gains. In the longer run,

prices which were too high would lead to demand destruction, price

collapse, and — worse still — an economic incentive to seek out

alternatives.

Second, because both Saudi Arabia and the

US SPR –

acting as implicit central banks of oil — now stand ready to cap prices

if and when they begin to threaten to destabilise the system.

Under which scenario, it’s easy to imagine prices staying range bound for a long while still.

Of course, if volatility was to be let loose in an environment of

negative yields — as it was in 2008 — we would arguably return to the

more erratic cycle of artificially propped up prices leading to demand

destruction, leading to price collapse, leading to society seeking out

alternatives and weaning itself off commodity dependence.

The shale revolution in the United States fits that story beautifully, we think.