The stock market just finished its worst May since 1940. As it turns out, watching France fall to the Nazis isn't good for stocks here. Also, watching the euro fall to reality is pretty nasty as well.

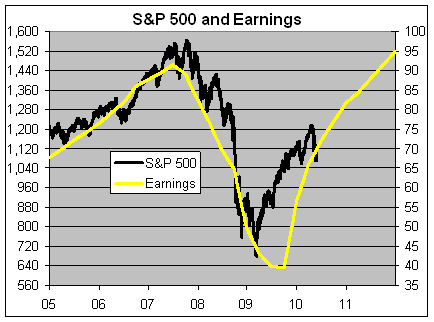

Let's take a closer look at where the market stands today. Here's the S&P 500 (black line, left scale) along with its earnings (gold line, right scale).

I've scaled the two lines at a ratio of 16 to 1 so whenever the lines cross, the market's P/E Ratio is exactly 16.

Let me add that looking at the market's P/E Ratio is far from perfect (the future earnings line is, of course, merely forecast), but nevertheless we can gain some insights as to what investors are thinking at the moment.

Two items stand out. The first is that the S&P 500 has fallen below a P/E Ratio of 16 which has generally been its lower bound over the past few years. The second is that the earnings forecast is still very favorable. If stocks keep pace with valuations, then the S&P 500 could easily be over 1400 within 18 months.

This is where the problems come in. It appears that investors are beginning to question the robustness of the recovery. Given the amount of aid needed, that's certainly understandable. So if the earnings forecast turns out to be overly optimistic, then the whole bullish scenario falls apart.

No comments:

Post a Comment